Compute payroll taxes

Ad Payroll Doesnt Have to Be a Hassle Anymore. No Need to Transfer Your Old Payroll Data into the New Year.

How To Calculate Federal Withholding Tax Youtube

Ad Fast Easy Accurate Payroll Tax Systems With ADP.

. It also includes calculating taxes and social security as well as ensuring that they are properly withheld and. The Best Online Payroll Tool. Learn About Payroll Tax Systems.

Free salary hourly and more paycheck calculators. For example if an employee earns 1500 per week the individuals annual. Ad Easy To Run Payroll Get Set Up Running in Minutes.

There are many ways to calculate payroll taxes. Taxes Paid Filed - 100 Guarantee. Ad Choose From the Best Paycheck Companies Tailored To Your Needs.

As an employer you match that contribution out. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment.

How to calculate employer payroll taxes FICA taxes In 2020 62 of an employees paycheck should go toward Social Security. Employers can use it to calculate net pay and figure out how. Payroll Deductions Online Calculator Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Ad Compare Sonarys Most Recommended Payroll Find The Perfect Match For Your Business. It only takes a few seconds to. Calculating Payroll Taxes The next step is calculating how much you will need to pay in payroll taxes.

The first step to calculate payroll taxes is calculating the wages earned by each employee and the amount of taxes that need to be withheld as part. Everything You Need For Your Business All In One Place. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

This is generally done by completing the following steps. Although the nominal payroll tax percentage is 6 most employers only have to pay 06 because of the 54 given as a credit to states. Sign up make payroll a breeze.

Sign Up Today And Join The Team. Free Unbiased Reviews Top Picks. In order to calculate the amount of taxes you owe.

Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. Find Easy-to-Use Online Payroll Companies Now. Ad Payroll Done For You.

For single filer you will receive. Over 900000 Businesses Utilize Our Fast Easy Payroll. Total annual income - Tax liability All deductions Withholdings Your annual paycheck How much is a paycheck on 40000 salary.

The basic process runs down as such. How to calculate payroll taxes how to pay payroll taxes and how to avoid an unfortunate run-in with the IRS. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms.

But calculating your weekly take-home. Ad Easy To Run Payroll Get Set Up Running in Minutes. Get It Right The First time With Sonary Intelligent Software Recommendations.

Start Afresh in 2022. Simplify Your Day-to-Day With The Best Payroll Services. Ad 4 out of 5 customers reduce payroll errors after switching to Gusto.

Ad Compare This Years Top 5 Free Payroll Software. How Your Paycheck Works. In our example the FUTA calculation.

Simply the best payroll software for small business. Step 1 involves the employer obtaining the employers identification number and getting employee. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Multiple steps are involved in the computation of Payroll Tax as enumerated below. Compute payroll taxes Selasa 06 September 2022 Edit. While the calculations may seem complicated theyre actually quite simple.

Taxes Paid Filed - 100 Guarantee.

Solved 1 Compute Werner S Gross Pay Payroll Deductions Chegg Com

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate Payroll Taxes In 5 Steps

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Federal Income Tax Fit Payroll Tax Calculation Youtube

Calculation Of Federal Employment Taxes Payroll Services

Excel Formula Income Tax Bracket Calculation Exceljet

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax Calculator For Employers Gusto

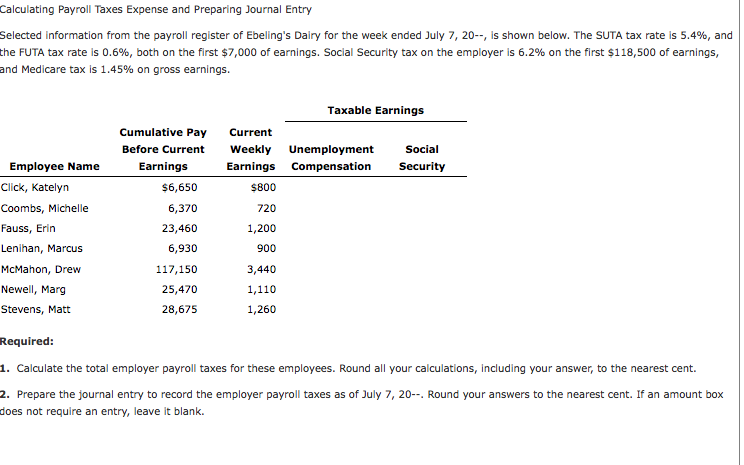

Solved Calculating Payroll Taxes Expense And Preparing Chegg Com

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Solved 1 Compute Werner S Gross Pay Payroll Deductions Chegg Com

How To Calculate Federal Income Tax

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

How To Calculate 2019 Federal Income Withhold Manually

How To Calculate Payroll Taxes Methods Examples More